Three weeks ago was a sad week for entrepreneurs throughout America. It was Wednesday, tax filing day; and many of us had to go through the awful experience of writing a big, fat check to Uncle Sam.

Yayyy!

As we, temporarily, leave grim times behind us, I have a confession to make – I’m TERRIBLE at managing my finances.

In an attempt to improve my finances, I decided to take an accounting class from Lynda.com.

As a result, I understand accounting principles better than before.

But here’s the problem – I haven’t done ANYTHING about it.

This has lead me to a realization. If I’m to get on top of my business finances, I need help.

While I do know entrepreneurs who are extremely successful, do their own bookkeeping and accounting, I know that I am not that kind of person.

Working on financial details drain my energy in a way that makes me less productive.

Bookkeeping vs. Accounting

When it comes to managing your business, you need to keep track of your income and expenses.

Bookkeeping deals with keeping a record of every financial transaction that happens in your business. A bookkeeper will also prepare invoices and do payroll (depending on the complexity of the business).

Accounting is more of a high-level process. Accounting takes the work done by a bookkeeper and expands upon it through the preparation of financial statements, tax returns and often, accountants provide advice on financial matters.

In speaking with a number of entrepreneurs, and considering my “mini-budget” (I’d just left my job and steady income), I learned that it was more important to get an accountant. In the mean time, I would keep track of the daily transactions.

The accountant would then make sure that my bookkeeping was accurate and would also take care of filing taxes, which had become more complicated since leaving my job.

Finding an Accountant

I was going to do all of the bookkeeping, partially because of finances, but in part because I wanted a clear perspective of where I stood financially.

It went very well for the first two months (ok, maybe a month and a half), and then it all fell apart. I just wasn’t consistent, and it got very frustrating. My intentions were in the right place, but tracking all of those little details just wasn’t my strong suit.

Also, my accountant wasn’t living up to my expectations, so I decided to leave her in search of a better solution.

The Better Solution

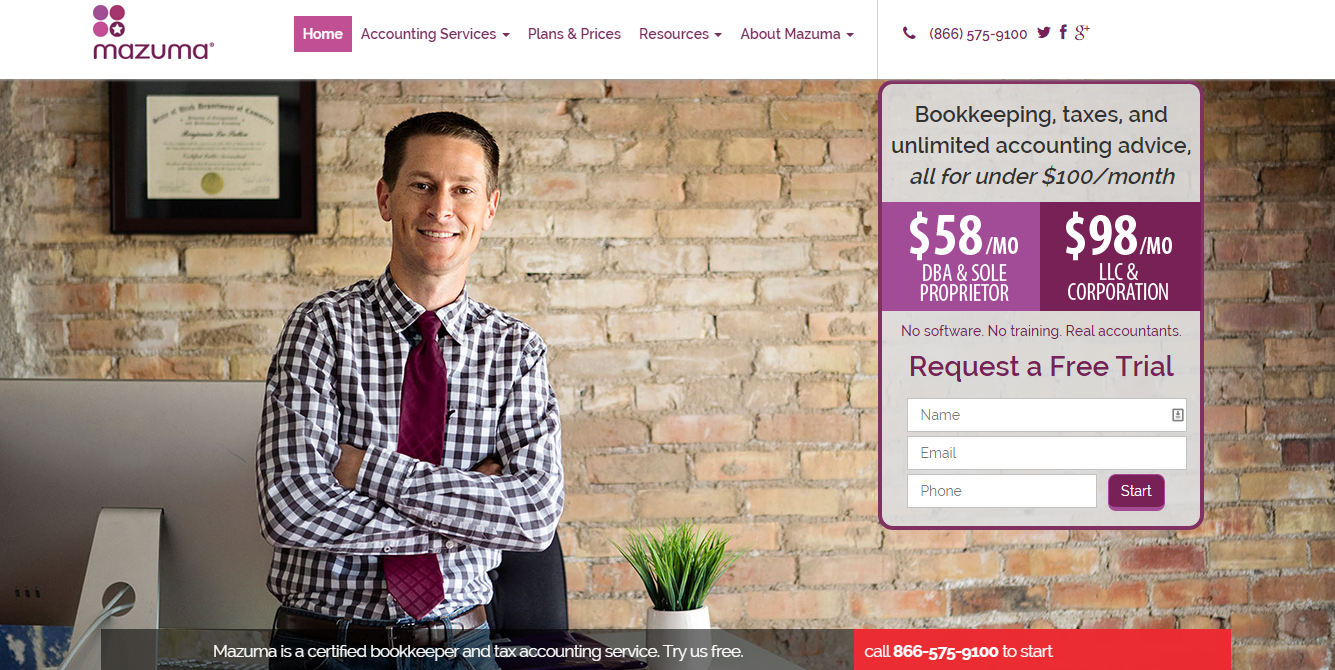

After evaluating a number of online services that take care of bookkeeping and accounting, I stumbled onto Mazuma..

Here’s what they provide:

- Bookkeeping for your business

- Unlimited accounting support. If you have accounting questions, they provide answers

- Preparation of taxes for filing.

They charge $58 for sole proprietor (not officially registered as a business).

If you’re an LLC or Corporation, they charge $98/month. In addition to that, if you’re an official business that also needs someone to handle payroll, you can pay $138/month and receive the above-mentioned services PLUS payroll.

This seemed unreal to me. Even on the high end, $138 is the amount I would pay for just a bookkeeper.

I even tried another online bookkeeping service (Bench.co) which started at $135. It was great, but I still needed an accountant.

So I decided to give Mazuma a try. They have a 1-month free trial where you get to test out their services to see how it works.

The Process

- They send you a purple pre-paid postage envelope in the mail and you send them financial statements for the month.

- You upload your statements to a file server.

Well, you know which option I went with – the file upload option. I sent them my Bank, Paypal and Stripe statements for December. A few days later, they sent me financial reports, which included my Income Statement, Balance Sheet, and a detailed Account Ledger.

Side note: This was my FIRST TIME having financial reports. I know – I’m that bad.

Since it was the first report they prepared for me, there were some items that weren’t categorized correctly.

They included instructions for me to provide feedback on the report. I asked them to correct categories. All in all, it was a pretty smooth transaction.

The Big T

While the mailing of the check was a bit painful, the tax preparation process was even more painful.

Since I’m a bit of a procrastinator when it comes to financial matters (just ask my wife), the days leading up to April 15th were a tad stressful, especially since I was in Vegas at the time.

Here’s the beautiful part. Since Mazuma is doing my monthly reports this year (since I’m DEFINITELY keeping the service), they are also handling my tax preparation. They will calculate my estimated quarterly payments and provide all the support I need.

Come April 15th, 2016, there will be no additional sweat pouring from my forehead.

Any downsides?

Remember when I said that I’m really bad when it comes to financial matters? Well, I wasn’t lying.

With Mazuma, they take care of all the bookkeeping AND accounting. All I have to do is send them my statements once/month.

Evidently, I suck at doing that. I’m preparing to send them January, February, and March right now.

You still have to gather your statements and send them in. I guess you can consider that a downside, but maybe it’s more of a personal problem 😉

However, their bookkeeping system is phenomenal. You log into their platform, connect your financial accounts, and your done. They take care of ALL the bookkeeping, and you don’t even have to worry about sending in statements.

You can see all of your reports in your account. It’s pretty much a hands-off process. However, the price starts at $135/month and can climb to $365 and beyond, depending on your income level.

The downside of a service like Bench.co is that you still have to find an accountant. Mazuma doesn’t have a platform like Bench, but as long as you can get your statements to them, they take care of EVERYTHING else.

In Conclusion

Sign up for a FREE 1 Month Trial

It’s less than you would pay elsewhere, and they do what they do very well.

IMPORTANT (for me): When you sign up, be sure to mention my name (Leslie Samuel) in the comments section. That way I get credit for referring you 🙂

Your Turn

How are you handling your business finances? Do you have a bookkeeper or an accountant? Or are you handling it all yourself? I’m curious. Let me know in the comments below.

Infographic